ITC Limited previously known as Imperial Tobacco Company of India Limited has advanced from its origins inside tobacco enterprise to turn out to be considered one of Indias major multi enterprise conglomerates. With numerous portfolio spanning Fast Moving Consumer Goods (FMCG) lodges paperboards and packagingnagribusiness ITC has hooked up itself as enormous player inside Indian marketplace.

The ITC proportion price serves as barometer for organisations financial health and market belief. As one of most widely held stocks in India ITCs proportion price movements now not best have an effect on individual buyers however also have broader implications for market indices and general sentiment inside FMCG quarter.

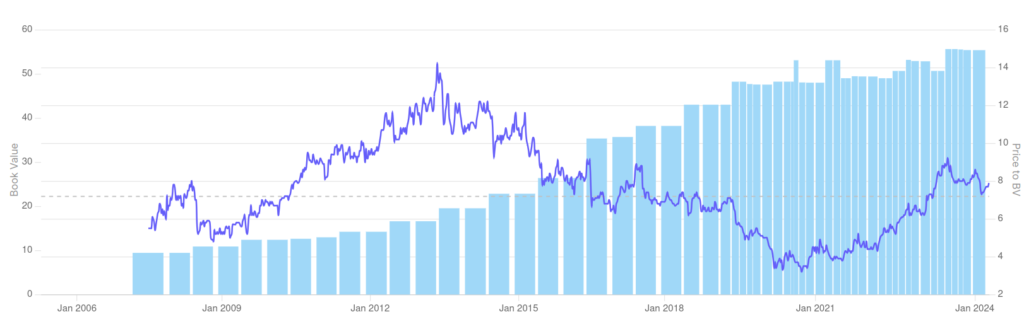

Over past decade ITCs proportion charge has experienced both durations of steady increase and phases of consolidation. inventory has been recognised for its balance and constant dividend payouts making it favorite among price traders and people seeking ordinary income.

Key milestones affecting proportion price

Several great occasions have influenced ITCs proportion fee over time:

- Diversification into non tobacco organizations

- Expansion of FMCG portfolio

- Implementation of GST and its effect @ cigarette enterprise

- Corporate restructuring projects

These milestones have played crucial roles in shaping investor notion and driving percentage charge moves.

Factors Influencing ITC Share Price

Understanding factors. that impact ITCs share price is crucial for investors and marketplace analysts alike. Lets discover important thing drivers:

Company financials

ITCs financial overall performance inclusive of sales boom earnings margins n coins flows without delay impacts its share price. Quarterly and annual outcomes are carefully watched by using traders for signs and symptoms of boom or capacity demanding situations.

Industry traits

As conglomerate with numerous enterprise hobbies ITCs percentage fee is tormented by traits in numerous sectors:

- FMCG market increase and purchaser spending patterns

- Hospitality industry overall performance

- Paper and packaging call for

- Agricultural commodity fees

Changes in those sectors can have ripple outcomes on ITCs average performance and therefore its proportion price.

Government rules

Given ITCs extensive presence within tobacco enterprise government guidelines and policies play critical role in shaping its commercial enterprise surroundings. Factors such as:

- Tobacco taxation

- Health warnings and advertising and marketing regulations

- Foreign direct investment (FDI) regulations

can appreciably impact agencys profitability and investor sentiment.

Market sentiment

Broader marketplace conditions investor danger urge for food n macroeconomic factors all make contribution to general sentiment surrounding ITC stocks. During periods of market volatility ITCs inventory is regularly visible as shielding play because of its solid commercial enterprise model and constant dividend payouts.

ITCs Business Segments

ITCs diversified enterprise version is key aspect in its percentage fee overall performance. Lets take look @ each segment and its effect:

FMCG

The FMCG segment has been main growth motive force for ITC in latest years. With popular manufacturers like Aashirvaad Sunfeast n Bingo this division has helped lessen business enterprises dependence on tobacco revenues. success and enlargement of FMCG products have undoubtedly prompted investor perception and proportion rate.

Hotels

ITCs luxurious resort chain contributes to organisations top class photo and diversification strategy. While hospitality zone may be cyclical it affords consistent revenue circulation and enhances business enterprises emblem value.

Paperboards & Packaging

This section has shown consistent growth profiting from accelerated demand in e trade and sustainable packaging answers. Its overall performance has contributed to general balance of ITCs percentage rate.

Agri Business

The agri enterprise section now not simplest helps ITCs FMCG operations but also contributes to export income. Its overall performance can effect enterprises usual profitability and by way of extension percentage price.

Impact on share fee

The relative performance of these segments and their contribution to ITCs standard revenue and profit blend play vast position in figuring out investor sentiment and percentage fee moves.

Comparative Analysis

ITC vs competitors

To benefit angle on ITCs share rate performance it is critical to evaluate it with its friends in FMCG and conglomerate space. Companies like Hindustan Unilever Nestle India n Godrej Consumer Products function beneficial benchmarks for assessment.

Key metrics for evaluation include:

- Revenue increase fees

- Profit margins

- Return on equity

- Price to income ratios

Sector overall performance

ITCs proportion rate need to additionally be regarded inside context of broader quarter performance. FMCG region in India has shown robust boom in recent years pushed by way of increasing consumer spending and urbanization. However it has also faced challenges which includes rural demand slowdown and inflationary pressures.

Comparing ITCs percentage charge movement with quarter indices like Nifty FMCG can offer insights into enterprises relative overall performance and investor perception.

Dividend History

Dividend payout ratio

ITC has recognition for being consistent dividend paying stock which is widespread thing in its enchantment to investors. organizations dividend payout ratio which measures percentage of income paid out as dividends has remained highly high over years.

Impact on shareholder price

The regular dividend coverage has numerous implications for ITCs share rate:

- Attracts profits focused investors

- Provides ground for proportion fee @ some stage in marketplace downturns

- Signals managements self belief within corporations cash go with flow generation

However it is critical to be aware. that high dividend payout ratio can also imply limited reinvestment inside commercial enterprise which some growth oriented investors can also view carefully.

Technical Analysis

Technical analysis can provide insights into short term fee movements and buying and selling styles of ITC shares.

Key assist and resistance degrees

Identifying crucial guide and resistance tiers can help buyers and traders make knowledgeable selections approximately access and exit points. These stages frequently coincide with ancient price points in which stock has proven massive buying or selling strain.

Moving averages

Popular shifting averages such as 50 day and 200 day MA are often used to gauge general fashion of ITCs proportion fee. Crossovers between these moving averages can sign capability fashion modifications and generate trading alerts.

Volume evaluation

Trading volume presents precious information about energy of charge actions. Unusual spikes in quantity specifically when observed through sizable rate changes can imply vital shifts in marketplace sentiment towards ITC stocks.

Fundamental Analysis

Fundamental evaluation enables in determining intrinsic price of ITC stocks based on its financial performance and boom prospects.

Price to Earnings (P/E) ratio

ITCs P/E ratio compared to its historic average and enterprise friends can suggest whether stock is distinctly overvalued or undervalued. decrease P/E would possibly advocate undervaluation even as better P/E should imply high boom expectations or potential overvaluation.

Return on Equity (ROE)

ROE measures how efficiently ITC generates income from shareholders fairness. consistently high ROE can justify top class valuation and definitely effect share charge.

Debt to Equity ratio

ITCs capital shape as reflected in its debt to equity ratio gives insights into organizations monetary threat. decrease ratio normally suggests more potent stability sheet. that could help higher share fee valuation.

Institutional Investors

The presence of massive institutional buyers can extensively affect ITCs proportion fee. Key stakeholders consist of:

- Domestic mutual funds

- Foreign institutional investors

- Insurance companies

- Government owned entities

Changes in institutional holdings

Monitoring changes in institutional holdings can provide treasured insights:

- Increased institutional buying regularly alerts self assurance inside organizations prospects

- Significant sell offs may also indicate worries approximately destiny performance or valuation

These actions may have sizable impact on ITCs share rate because of large volumes concerned.

Analyst Recommendations

Financial analysts regularly offer pointers on ITC stocks based totally on their evaluation of organizations prospects. These scores can have an effect on investor sentiment and trading hobby.

Target prices

Analyst goal fees for ITC shares offer benchmark for capacity destiny rate movements. Significant changes in consensus goal prices can drive brief time period percentage fee fluctuations.

Recent Developments

Recent company moves along with share buybacks bonus issues or stock splits will have immediately and long term effects on ITCs share charge. These actions regularly sign managements confidence within employers monetary role and destiny possibilities.

ITCs non stop innovation in its FMCG portfolio such as introduction of recent products or access into new categories can definitely impact investor notion and proportion rate performance.

Expansion plans

Announcements regarding growth into new markets potential additions or strategic acquisitions can power pleasure among buyers and probably result in share price appreciation.

Risks and Challenges

Regulatory demanding situations

The tobacco industry faces ongoing regulatory pressures consisting of potential will increase in taxation and stricter marketing regulations. These elements pose continual risks to ITCs center enterprise and might create uncertainty round destiny earnings.

Competition

Intense opposition in FMCG sector from each home and multinational gamers poses undertaking to ITCs marketplace share and profit margins. agencys capability to preserve its aggressive facet is crucial for maintaining proportion fee growth.

Economic elements

Macroeconomic conditions including GDP boom inflation rates n customer spending patterns can effect ITCs performance across its various enterprise segments probably affecting its percentage rate.

Growth possibilities

ITCs future growth prospects particularly in its non cigarette FMCG business will play essential function in figuring out its lengthy term percentage price trajectory. Investors will closely watch agencys capacity to scale up its more recent companies whilst retaining profitability in its middle segments.

Potential catalysts for share rate

Several elements could function catalysts for ITCs percentage rate within coming years:

- Accelerated growth inside FMCG section

- Recovery inside hospitality quarter publish pandemic

- Potential fee unlocking through business restructuring

- Innovations in sustainable and ESG targeted projects

Investor Strategies

Investors ought to keep in mind their investment horizon whilst approaching ITC shares:

- Long time period traders may additionally recognition @ agencys stable dividend yield and ability for value appreciation

- Short time period buyers may capitalize on technical signs and information driven price movements

Portfolio diversification

Given ITCs numerous business version it may serve as stabilizing pressure in investment portfolios. However traders need to remember their normal publicity to FMCG quarter and Indian marketplace when allocating finances to ITC stocks.

ITC stays sizeable participant inside Indian stock market with its proportion charge serving as an important indicator of each company unique overall performance and broader market traits. While past performance has been characterised by means of balance and consistent returns future share price movements will rely upon companys capacity to adapt to changing purchaser preferences regulatory landscapes n competitive pressures.

Investors thinking about ITC shares have to conduct thorough studies thinking about each opportunities presented by using its sturdy market role and capacity risks related to its various commercial enterprise version. As continually it is advisable to seek advice from monetary advisors and recall person funding goals and chance tolerance earlier than making investment decisions.